Posted by: Emma Hickey, Senior Content Contributor

Editor's Note: Welcome to the first in a new series in our News + Notes, Poros Pro Tips! We'll share tips and tricks we've picked up along the way for living your best career life.

Every time I start a new job, I need to call my dad to ask for his help filling out my W-4. You’d think that one of these days the information would stick in my mind and I’d be able to complete the form as the independent young woman that I am, but that day has yet to come. Fortunately, my dad is a CPA with 30 years of experience and he never tires of answering my questions--for now, at least. This tax season, I thought I’d pick my dad’s brain one last time and try to actually understand how a W-4 works, then share it out with anyone who might have the same questions I did. Hopefully next time we’ll all be able to fill out our W-4s without any parental guidance at all!

First things first, there are a lot of other tax forms out there besides the W-4, and I know I always get them mixed up. Let’s start by taking a high level look at a few of the main ones.

Tax Forms

W-4

The W-4 is the form you fill out when you start a new job. This is where you tell your company how much money you want them to take out of your paychecks and send to the government on your behalf. You accomplish this by claiming a number of withholding allowances from 0 to 10. Here’s what the W-4 looks like:

https://www.irs.gov/pub/irs-pdf/fw4.pdf

W-2

The W-2 is a form your company fills out and gives to you at the end of the year. Its purpose is to report to you how much money you made over the course of the year and how much money your company took out of your paychecks (as determined by the withholding allowances you claimed in your W-4) and sent to the government. The W-2 looks like this:

https://www.irs.gov/pub/irs-pdf/fw2.pdf

Basically, the W-4 is where you tell your company how much of your paycheck you want them to send to the government in terms of withholding allowances, and the W-2 is where your company reports back to you at the end of the year exactly what that looked like in terms of dollars.

W-9

If you’re working for a company as an independent contractor and not as an employee, you fill out a W-9 at the start of your job instead of a W-4. The W-9 is a request from the company that hired you for your Social Security Number or your Taxpayer Identification Number (which is essentially a Social Security Number for a business). When you’re an independent contractor, the company you work for is not required to send taxes on your behalf to the government--you have to do that for yourself--but they are required to report to the government how much money they paid you during the year. In order to make that report at the end of the year, they need your Social Security Number (or Taxpayer Identification Number) and the W-9 is how they get it. It looks like this:

https://www.irs.gov/pub/irs-pdf/fw9.pdf

1099

Finally, there’s the 1099, which is also a form for independent contractors. At the end of the year, the company that hired you as an independent contractor uses your Social Security number (which they got from your W-9) to fill out a 1099 form where they report all the money that they paid you over the course of the year, and they submit a copy of this report to the government and to you. Then you’ll use the information from your 1099 to prepare your personal income tax return and pay your taxes. It looks like this:

https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

Now that we have a sense of what all these different forms are and how they fit together, let’s dive into the W-4.

A Closer Look at the W-4

The W-4 is two pages long, but the important part, and the only part the IRS will look at, is the bottom half of page 1:

https://www.irs.gov/pub/irs-pdf/fw4.pdf

Ultimately, the information the government needs from you is your name, your address, your Social Security Number, whether you’re filing your taxes as a single individual or jointly as a married couple, and the number of tax allowances you’re claiming.

Now for the big question--what is a tax allowance and how many should I list in Box 5?

https://www.irs.gov/pub/irs-pdf/fw4.pdf

The government dictates that you do not have to pay taxes on all of the money you make and spend over the course of a year. We are all entitled to certain income reductions and deductions before the ultimate tax is calculated. The goal of the W-4 is to guess, as accurately as possible, the amount of your deductions, and to determine how much of your money should come out of each of your paychecks based off your income level and deduction amounts.

The amount of money you withhold in taxes is determined by the IRS’s withholding table (officially known as the Circular E), and the number of allowances you claim on your W-4 corresponds with the withholding table. The withholding table was most recently changed during the Trump Tax Cuts and Jobs Act of 2017 and the W-4 has yet to updated accordingly, as of this writing.

During tax season, you, or your tax software, or your accountant, or, if you’re me, your dad,

prepares your actual income tax return to determine your true tax obligation. It’s at this point you learn how close the money you withheld in taxes during the year (as determined by the number of withholding allowances you claimed on your W-4) matches the amount of tax as calculated by your actual income tax return, also known as Form 1040.

You get a tax refund at the end of the year if you withheld more money in tax withholdings than necessary each pay period, and you owe taxes if you withheld less money than necessary each pay period.

Is your head spinning yet? Mine is! Let’s keep it simple. If you’re a single, young person just starting out in your career like me, here’s what happens when you claim different withholding allowances on your W-4:

- 0 = The government will take the most money out of your paycheck each pay period, and you will likely get a big tax refund at the beginning of the new year.

- 1= The government will take a lot of money out of your paycheck each pay period, but not as much as if you claimed 0. You’ll likely get a pretty big tax refund at the beginning of the new year.

- 2 = The government will not take out as much money from your paycheck each pay period, meaning your paychecks will be larger each pay cycle than if you claimed 0 or 1. You’ll likely get a smaller tax refund at the beginning of the new year, or you may owe a small amount of taxes.

It may seem like a good idea to claim 0 and get a big tax refund, but keep in mind that if you do this, the money you’ll get as your tax refund is money you could have been getting every month in your paycheck, and the government isn’t going to pay you any interest on the dollars of yours they were holding onto throughout the year in the way a bank would. From a money management standpoint, it might make more sense for you to claim a 1, or possibly a 2, on your W-4 and get more money in your paycheck each pay cycle. In other words, don’t give the government an interest-free loan!

It’s also important to keep in mind that the number you claim in your W-4 isn’t set in stone--you can change it it every month if you’d like, and you can definitely change it after you file your taxes and maybe realize that your refund was so big you could probably claim a larger number and get more money in your paycheck each month without owing tax money at the end of the year.

Common W-4 Pitfalls

If you have multiple jobs, or you’re married and you and your spouse both have jobs, then you may fall into a common W-4 pitfall that could result in you owing taxes at the end of the year.

Multiple Jobs

Let’s say you have one job where your salary is $45,000 and you claim 2 withholding allowances on your W-4. Congratulations, you’re most likely on your way to a small tax refund at the end of the year! Then you get a second job where your salary is $5,000, and you decide to claim 2 withholding allowances because that’s what you did for your other job. Now you’re at risk of owing taxes at the end of the year.

The problem is that the withholding table doesn’t know you have two jobs. If you claim 2 on a $5,000 salary, you won’t have to withhold any taxes from your paychecks because your salary is so low. The entire $5,000 will go into our pocket. When you file your taxes at the end of the year, though, your two salaries are combined and the money you owe in taxes is determined by that combined total of $50,000, not just the $5,000. Since you didn’t withhold any taxes on $5,000 of your $50,000 dollars, you will owe the government taxes.

In order to avoid this scenario, make sure the withholding allowance you claim on your W-4 is based off of your total salary, in this example $50,000, and not based off of $45,000 and $5,000 respectively.

Multiple Earner Household

The common tax pitall for married couples in which both partners have jobs is very similar to the pitfall for single people who hold multiple jobs. If you have a job where you make $45,000 a year and your spouse has a job where they make $5,000 a year, your tax obligation will be determined by your combined income of $50,000. That means that if you withheld taxes every paycheck for your $45,000 salary, if your spouse did not withhold any taxes for their $5,000 salary, you’ll ultimately owe taxes because as a unit you did not withhold taxes from $5,000 of your $5,000 dollars.

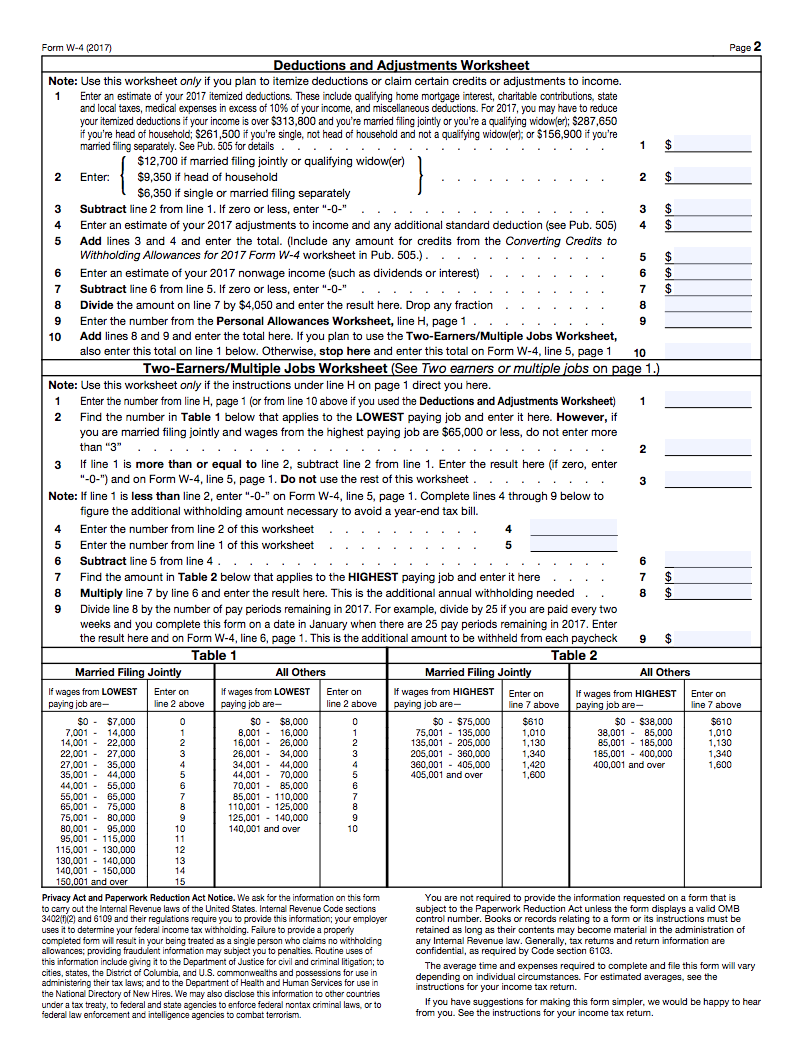

The best way to avoid these two pitfalls is to flip to page two of the W-4 and fill out the worksheet. Most people ignore the second page of the W-4, but if you have multiple jobs or you’re in a two-earner household, then the second page of the W-4 is a valuable resource for you to help determine what you should claim as your tax withholdings.

https://www.irs.gov/pub/irs-pdf/fw4.pdf

And that’s everything there is to know about taxes! Just kidding. Tax laws and codes and forms are complicated, and they’re subject to change as they did in December of 2017 when the government passed a sweeping tax reform. This should be everything you need to know about completing a simple W-4, though. I hope the next time you have to fill one out, you don’t even think about calling your parents for help. I know I won’t!